What we are looking for

- USD strengthening bias remains in play: Even as the dust settled yesterday following huge moves on Tuesday, there remains a USD positive bias running through forex major pairs.

- Indices tick a shade higher amid consolidation: After the huge sell-off earlier in the week, indices largely settled yesterday and remain so this morning. With US futures trying to build support, European indices are edging back higher.

- Commodities pulling lower: Silver and oil have been holding up relatively well in recent days, however, there is a negative bias to moves this morning. Gold continues to drift lower.

- Data trading: Traders should watch the EUR with the Eurozone Wage Growth, as this is something that the ECB will certainly be watching. Of the 12:30 GMT US data, Retail Sales will likely be the market mover for the USD, but any other significant surprises jobless claims or Fed surveys could also impact. US Industrial Production will also impact the USD a little later.

Overview

After the tumultuous sell-off across risk assets following Tuesday’s US CPI upside surprise, markets have been trying to settle again. Indices are building from support, whilst cryptocurrencies have also rebounded. However, there is still a USD positive bias to major forex and with Treasury yields edging ever higher, any risk positive moves on major markets are still likely to be short-lived.

Furthermore, investors will be wary of backing a rally in equity markets without some sort of protection. We watch for a reaction on the VIX Index of S&P 500 options volatility. A higher VIX means that portfolio managers are buying put options to protect them from another sell-off on equities. A rising VIX as an equities rally can be a warning sign. This was seen on Monday before Tuesday’s massive sell-off. The VIX dropped yesterday, but we are on alert for any rises as equities rebound again. US Retail Sales is the next risk event to watch out for.

The economic calendar has a slew of US data today. However, initially, the Eurozone Wage Growth will be watched, with a sizable jump expected in Q2. There is a batch of US data at 12:30GMT. US Retail Sales will get the headlines, with core sales expected to grow only marginally in August. This would be the eighth consecutive monthly growth in retail sales. Weekly Jobless Claims are expected to rise slightly in the past week. However, in each of the past four weeks, analysts have predicted a rise and the claims have fallen. There are also two Fed surveys, with the New York Fed Manufacturing expected to recover after last month's massive negative surprise. The Philly Fed is expected to improve only marginally, but both are forecast to remain negative. US Industrial Production is expected to show only marginal growth in August.

Today’s news

Market sentiment is stable, for now: Equity markets are trying to build from support. However, the USD is hinting at further strength and commodities are slipping.

Treasury yields continue to edge higher: After consolidation yesterday, Treasury yields are pushing higher again this morning. Bond markets continue to price for a more hawkish Fed.

New Zealand Q2 growth higher than expected: Q2 GDP comes in at +1.7% QoQ, higher than the +1.0% consensus. Growth was -0.2% in Q1.

Australian Unemployment ticks higher: Unemployment ticks up to 3.5% in August (from 3.4% in July). The participation rate improved to 66.6% (from 66.4%)

Swedish Prime Minister to resign: After losing the election, Prime Minister Andersson has announced that she will step down.

Cryptocurrencies try to rebound: After falling for the past couple of sessions, cryptocurrencies are looking to rebound today. Bitcoin is c. +1% higher and back above $20,000. Ethereum is +2% higher at $1633.

Economic Data:

- Eurozone wage growth – Q2 (at 09:00 GMT) – Wages are expected to have jumped in Q2, increasing to 5.8% YoY (from 2.7% in Q1)

- US Retail Sales – ex-autos (at 12:30 GMT) Core sales are expected to have increased by +0.1% in August (slightly down from the +0.4% growth in July)

- US Weekly Jobless Claims (at 12:30 GMT) Claims are expected to have increased slightly to 226000 (from 222000 in the previous week)

- NY Fed Manufacturing (at 12:30 GMT) The gauge is expected to improve to -13 in September after the sharp decline to -31.3 in August.

- Philly Fed Business (at 12:30 GMT) The gauge is expected to have marginally improved to -8.0 in September (from -10.6)

- US Industrial Production (at 13:15 GMT) Production is expected to grow by just +0.1% in August reducing the year-on-year growth to 3.5% (from 3.9% in July)

Major markets outlook

Broad outlook: Markets are still looking to stabilise following Tuesday’s huge risk sell-off.

Forex: There is a mild USD strengthening today, but with a slight risk positive bias as JPY underperforms and AUD performs slightly better.

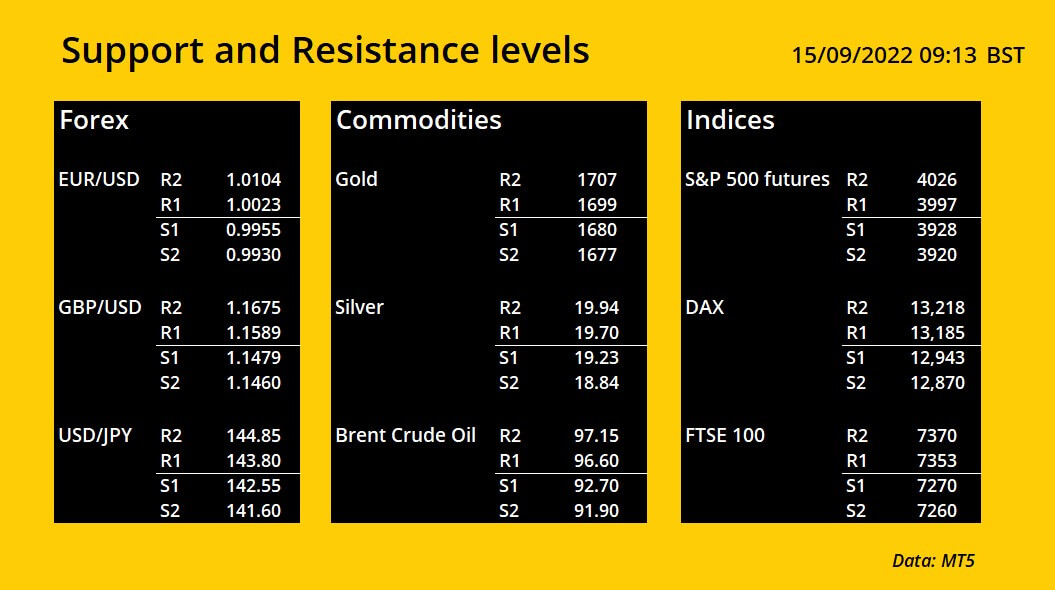

- EUR/USD has tried to stabilise once more around the support band 0.9900/0.9950. However, there is a lack of buying pressure so far and initial resistance on a near-term rebound is coming in at 1.0030. The importance of resistance at 1.0197 is growing on a medium-term basis.

- GBP/USD managed to tick higher yesterday to ease the downside pressure, however, the move has begun to slip back again this morning. We continue to favour selling into strength and the big bull failure on Tuesday has strengthened the resistance between 1.1715/1.1760. The initial resistance comes around 1.1590 (yesterday’s rebound high) and 1.1600. Initial support is at 1.1460/1.1480 with 1.1405 being the key low.

- AUD/USD rebounded well from the low of 0.6705 yesterday to post a positive candle. Initial gains today (as other major currencies are slipping against the USD) reflect a more positive feel to the AUD. Above the old pivot at 0.6775 opens resistance at 0.6820.

Commodities: Gold is struggling as the rebound in silver consolidates. Oil is also consolidating.

- Gold has been struggling since the bull failure around the resistance between $1720/$1729. Another negative candle yesterday and early downside this morning is now testing the key medium to long-term support of the lows between $1680/$1691. With corrective configuration on daily and four-hour chart momentum indicators, near-term rallies remain a chance to sell. A breach of $1677 is a three-year low and opens $1550/$1610. Initial resistance is around $1707/$1710.

- Silver rallied harder than gold recently and has also held up much better. The bull failure at $20.00 has spent the past few days now buzzing around the old pivot band of $19.42/$19.54. Momentum indicators are holding up well on both daily and four-hour charts but a decisive move below yesterday’s low of $19.23 would begin to develop lower highs and lower lows again.

- Brent Crude oil has held up well despite the tumultuous moves in other major markets. The consolidation remains around the overhead supply of the old lows between $93.25/$95.90. A reaction high at $96.40 now becomes an important level to watch near-term whilst the bulls are looking for a move above $98.30 to open a test of the three-month downtrend (currently c. $101). We are still cautious of backing recoveries for fear of further bull failures with the RSI stuck under 50, we will remain cautious. Initial support is at $91.90.

Indices: The recovery has been smashed to pieces. The key now is how traders react to the rebound.

- S&P 500 futures have stabilised following Tuesday’s huge sell-off. A positive candle yesterday and a consolidation move this morning are helping to settle the nerves. . However, traders will be cautious about backing rallies after the previous two rebounds in the past month have resulted in huge declines again. The market has ticked slightly higher this morning in a mild unwind. Initial resistance is at 3997 and there is an old pivot band around 4020. Holding the support band between 3888/3920 will be key now.

- German DAX posted a “spinning top” candlestick yesterday. A candle of indecision might be seen as something of a relief following the sharp decline. However, this is being followed by further consolidation today. The reaction to yesterday’s high of 13187 will be initially a gauge. Support at 12943 also now needs to hold to prevent a fall towards 12590/12675.

- FTSE 100 remains choppy with huge swings over the past week. The market is trying to settle this morning. The four-hour chart shows initial support at 7260 and some encouraging candles. However, a move above 7353 resistance is needed to engage a more encouraging outlook once more.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.