Outside of the corrective oil price, commodities have recovered well in the past month. However, that recovery is now being threatened. A stream of concerning economic data from major economies, a strengthening US dollar (USD) and peak US inflation are all factors. The outlook is starting to turn corrective again.

- Demand fears continue to rise.

- The USD is once more coming back into favour. This is negative for metals.

- Inflation is peaking in the US. This is weighing on inflation expectations, which is a drag on metals.

Demand fears weigh on commodities

Commodities are a pro-cyclical asset class. When the outlook for the global economy is improving, commodities tend to perform well. However, this is not always the case.

The recovery in July was driven by market expectations that major central banks such as the Federal Reserve would not be hiking interest rates as aggressively. Fewer interest rate hikes would be positive for risk appetite, and subsequently, commodities recovered. This also drove a USD correction.

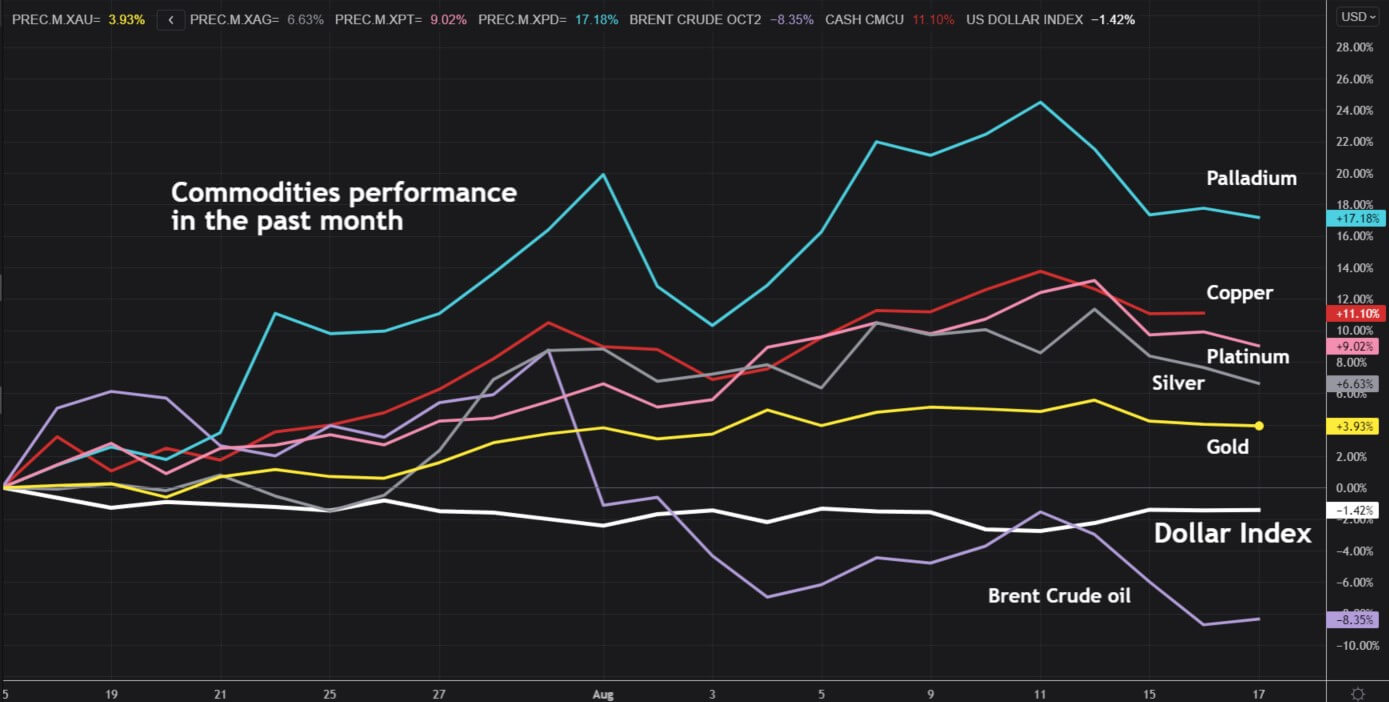

We can see that in the past month, commodities are higher (except for crude oil). Note also how the US Dollar Index is also lower.

However, in the past week, this has started to turn around. Commodities are beginning to fall again. There are mounting concerns over the economic slowdown of China and the Eurozone.

However, in the past week, this has started to turn around. Commodities are beginning to fall again. There are mounting concerns over the economic slowdown of China and the Eurozone.

Chinese industrial production and retail sales data badly missed expectations in July. China is a massive consumer of commodities. Lower growth in China equals less demand for commodities. Economic data for the Eurozone is also disappointing (German ZEW, and the downward revision of Eurozone GDP today).

We are seeing a shift towards a more risk-averse positioning. Commodities are beginning to decline and the USD is beginning to strengthen again.

A stronger USD remains negative for commodities

We can see on the charts that a stronger USD remains negative for commodities. We can see here how the price of gold and the USD are still strongly negatively correlated. The correlation has been especially strongly negative since May. A positive USD is negative for gold.

Inflation expectations tailing off again weighs on commodities

Inflation expectations tailing off again weighs on commodities

There is also a strong relationship between inflation expectations and commodities. The US reaching peak inflation in the past few months has weighed on inflation expectations. This played a role in the gold price being dragged lower in Q2.

A spike higher in inflation expectations (driven by the perception that the Federal Reserve had pivoted in a dovish direction in the June FOMC meeting) allowed gold to rebound.

However, we are now seeing inflation expectations rolling over again. Fears of receding demand (from China) and the insistence from FOMC members that the Fed remains on a hawkish path, are pulling inflation expectations lower once more. This is beginning to drag on commodities.

The chart below shows the strong positive correlation between US inflation expectations (as measured by the US 10-Year Breakeven Inflation rate) and gold.

Are commodities on the turn?

We are starting to see the recovery in metals starting to wane. But will this turn into a more corrective phase? For now, the recovery trends are holding. However, these are getting tested across the sector and if the move lower continues, a more corrective configuration would develop.

The recovery of Copper is now seriously threatening its one-month recovery uptrend. A move below 3.543 support would suggest the recovery has lost its way. Below 3.411 would turn the market into a bearish corrective move. If the RSI went below 45 this would also be confirmed.

It is a similar story to Platinum (XPTUSD). The one-month recovery uptrend is being threatened. A breach of support at 922 would suggest the market has topped out (especially if confirmed by the RSI moving below 50).

Gold (XAUUSD) is looking even more corrective already. The recovery has faltered around the resistance of old support at $1785/$1805. The uptrend has been broken and corrective daily candles are mounting. For now, this is a stalling in the recovery, but if the market were to break below $1754 higher low support it would suggest a growing negative outlook once more.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.