There is less focus on the US this week, so the European Central Bank takes centre stage. A hike is expected, but uncertainty surrounding the size could mean a volatile reaction. The Reserve Bank of Australia and the Bank of Canada are also expected to hike rates this week.

Elsewhere there is a slew of unemployment, Q2 GDP and services PMIs. Inflation is once more key in LatAm.

Watch for:

- North America – ISM Services are key for the US, with the Bank of Canada interest rate decision.

- Europe – Final Composite PMIs for the Eurozone and UK, along with a crucial ECB monetary policy decision.

- Asia – The RBA rates decision and Chinese inflation

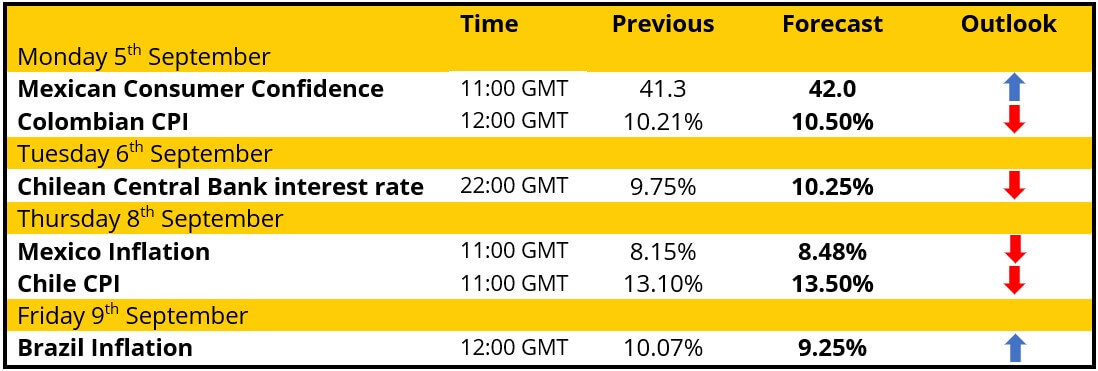

- LatAm – Inflation for Colombia, Mexico, Chile and Brazil; along with the Chilean central bank interest rates decision.

North America

N.B. Forecasts are the latest available consensus

US dollar (USD)

Markets have been listening to the steady stream of hawkish Fed speakers that have been served up recently. Add in the hawkish speech from Fed Chair Powell at Jackson Hole and expectations for Fed interest rate hikes have jumped in the past week. Markets are now all but pricing for rates to hit 4.00% around the year-end. A +75bps hike in September is almost nailed on now.

This all adds up to further USD strengthening in the weeks to come. Given the latest breakout on Dollar Index above 109.50 (to 20-year highs) there is a growing possibility of a near-term kick-back. However, with such a strong wave of momentum in favour of the USD, it is a risky trade to push against the tide.

Canadian dollar (CAD)

The Bank of Canada has been front-running the Fed throughout the tightening cycle. A 75 basis points hike is expected this week. This may allow CAD to build a degree of near-term support (perhaps even against the USD).

- USD/CAD – The strengthening of the USD has pulled the pair towards the top of the uptrend channel once more. It will be interesting to see if this move starts to falter now. The May, June and July rallies saw the daily RSI falter around 65/70 (where it currently sits. Initial support is around 1.3050/1.3075.

Commodities

We have seen the selling pressure ramping up on commodities, as the USD strength and negative risk sentiment have taken hold. The sharp rise in real US bond yields (yields minus inflation) has driven metals lower. If this rise in yields continues, the further metals prices will fall. On a technical basis, prices are becoming oversold and technical rallies will become due. This might induce a move to unwind oversold positions. However, we continue to see metals (and precious metals) as a sell into strength.

- Brent Crude Oil – is a swing trader’s dream. The price swings higher for a few days and then back lower. Once more after a period of selling pressure, the price is swinging higher. Resistance is around $98/$100 this week, with a sell into strength bias.

- Gold – is threatening a near-term rebound, but rallies are still a chance to sell. There is resistance in the band $1720/$1745 to look for the next opportunity. The bias is towards a retest of the July low at $1680 in due course.

- Silver – the outlook has turned decisively negative in the past few weeks and rallies are seen as a chance to sell. Any bull failures around the overhead supply between $18.14/$18.70 would be another opportunity.

Wall Street

Higher yields (and especially higher real yields) are a drag on Wall Street. Negative risk appetite adds momentum to selling pressure. Near-term recovery signals may induce a technical rally. However, remember September is statistically the worst month of the year for equities.

- S&P 500 futures – bouncing from 3903 leaves the support band at 3903/3950 with mounting importance to the medium-term outlook. A technical rally is threatening however, this would be a recovery within the latest downtrend, with resistance between 4075/4110 now key.

- NASDAQ 100 futures – a near-term technical rally threatens and is bolstering a band of support between 12020/12260. However, recoveries still look to be moves within a new multi-week downtrend. Initial resistance is at 12655.

- Dow futures – A near-term recovery from 31220 is threatening. However, with considerable overhead supply as resistance, the move may struggle for traction. Resistance is strong around 32340.

Europe:

N.B. Forecasts are the latest available consensus

Euro (EUR)

This will be a crucial meeting of the ECB on Thursday. A second rate hike is nailed on, but how big will it be? For a while, the consensus has been for 50bps, but this may be a bit dovish now. Several ECB members have been making hawkish noises in recent weeks and after Eurozone inflation came in hot, the potential for 75basis points has gathered pace. The EUR has tended to find support recently on this hawkish chat (at least on major crosses), so 75bps would add to this support.

- EUR/USD – the pair continues to find buyers around 0.9900/0.9950 support. However, attempted rallies have consistently failed to ignite and resistance around 1.0100 is strong. Reaction to the ECB meeting will be key to breaking this 200 pip range. A close either way would imply a 200 pip move in the direction of the break.

British pound (GBP)

GBP is an absolute basket case right now. The UK economy may already be in recession in Q3. Inflation could be in the mid-teens by the year-end. There is a political vacuum, with the likely next Prime Minister having little concept of how to help the country with a cost of living crisis. There are enormous twin deficits as the current account has fallen off a cliff and the fiscal deficit is set to balloon. The Bank of England has an incredibly difficult job to tame inflation without pushing the economy into an abyss. All the while, GBP is plummetting with no support of note on GBP/USD below 1.1400 until parity.

- GBP/USD – the pair retains a deeply negative outlook and rallies remain a chance to sell. With the RSI falling below 30 recently, this raises the potential for a near-term rebound. However, there is considerable resistance overhead between 1.1720/1.1900 to capture any unwinding move.

Indices

If European indices took the stairs higher in July and early August, they have taken the elevator back down. Risk appetite is very negative and equity markets are struggling to hold on to near-term gains. If US yields continue higher, Wall Street remains under corrective pressure, and then European indices will fall further. Any near-term recovery would be seen as a chance to sell.

- DAX – has fallen hard within what is now a three-week downtrend. Rallies remain a chance to sell even if they breach the downtrend. Resistance at 13000/13150 is a barrier to a serious recovery. We favour a test of the July lows around 12375/12425 in due course.

- FTSE 100 – may be able to muster some kind of technical rally this week as the RSI has hit 30. However, we would continue to see any near-term rallies as a chance to sell. There is resistance now between 7300/7370.

Asia:

N.B. Forecasts are the latest available consensus

Japanese yen (JPY)

Yield spreads remain key. Japanese JGB yields are barely budging so with Treasury yields soaring, the JPY is massively underperforming the USD. However, with Japan increasingly concerned by the weakness of the yen, the prospect of intervention rises. This might induce a knee-jerk rally on the yen.

Higher German Bund yields are also meaning that JPY is also underperforming EUR. Elsewhere, risk appetite is starting to be the dominant driver. This leaves the outlook for JPY versus the AUD potentially set to weigh AUD/JPY lower.

- USD/JPY – has broken out to multi-decade highs. The move is overbought on the RSI now. Breakout support for an unwinding move is at 138.90/139.40, with more considerable support at 137.70.

- AUD/JPY – has rallies to test the medium-term range resistance area between 95.30/96.20. There is an upside risk towards the June high of 96.88, but the RSI is not calling for a breakout.

Australian dollar (AUD)

The Reserve Bank of Australia (RBA) is expected to hike by 50 basis points this week. As is often the case, we will also be looking out for forward guidance on further rate hikes. This may need to be hawkish if the AUD is to build support (especially against the strengthening USD).

- AUD/USD – the breakdown below support at 0.6840/0.6880 has opened the July lows again. With the downtrend formation, rallies towards the resistance look to be a chance to sell this week.

New Zealand dollar (NZD)

Once more, with little major New Zealand data of note, the NZD will be largely attuned to movements in the AUD.

- NZD/USD – the pair seems to be struggling to sustain any recovery momentum right now. However, a near-term technical rally from the key July low at 0.6060 is threatening. Initial resistance is at 0.6150 but overhead supply looms above 0.6185.

LatAm:

N.B. Forecasts are the latest available consensus

Brazilian real (BRL)

In recent months we have seen Brazilian inflation continuing to show signs of topping out and falling back. We are expecting a fall for a third month in the last four. This will add to the growing expectation that the huge increases in interest rates may come to an end at the next meeting. This would be good news, even if the real has slipped back in the past week (mainly on USD strength).

- USD/BRL – the strengthening USD has dragged the pair back higher into the 5.23/5.36 resistance band. This continues the choppy near to medium term outlook. A move above 5.3600 would generate more decisive positive traction.

Mexican peso (MXN)

Although Consumer Confidence is forecast to improve slightly, the continued increase in inflation will keep the central bank firmly on track to continue to further increase the interest rate. The peso has been more stable than its South American peers but it is slipping again versus the USD.

- USD/MXN – despite renewing USD strength, the near to medium-term outlook on USD/MXN remains mixed. The support at 19.800/19.850 has been strengthened but the pivot resistance around 20.250/20.300 is still holding back a recovery.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.