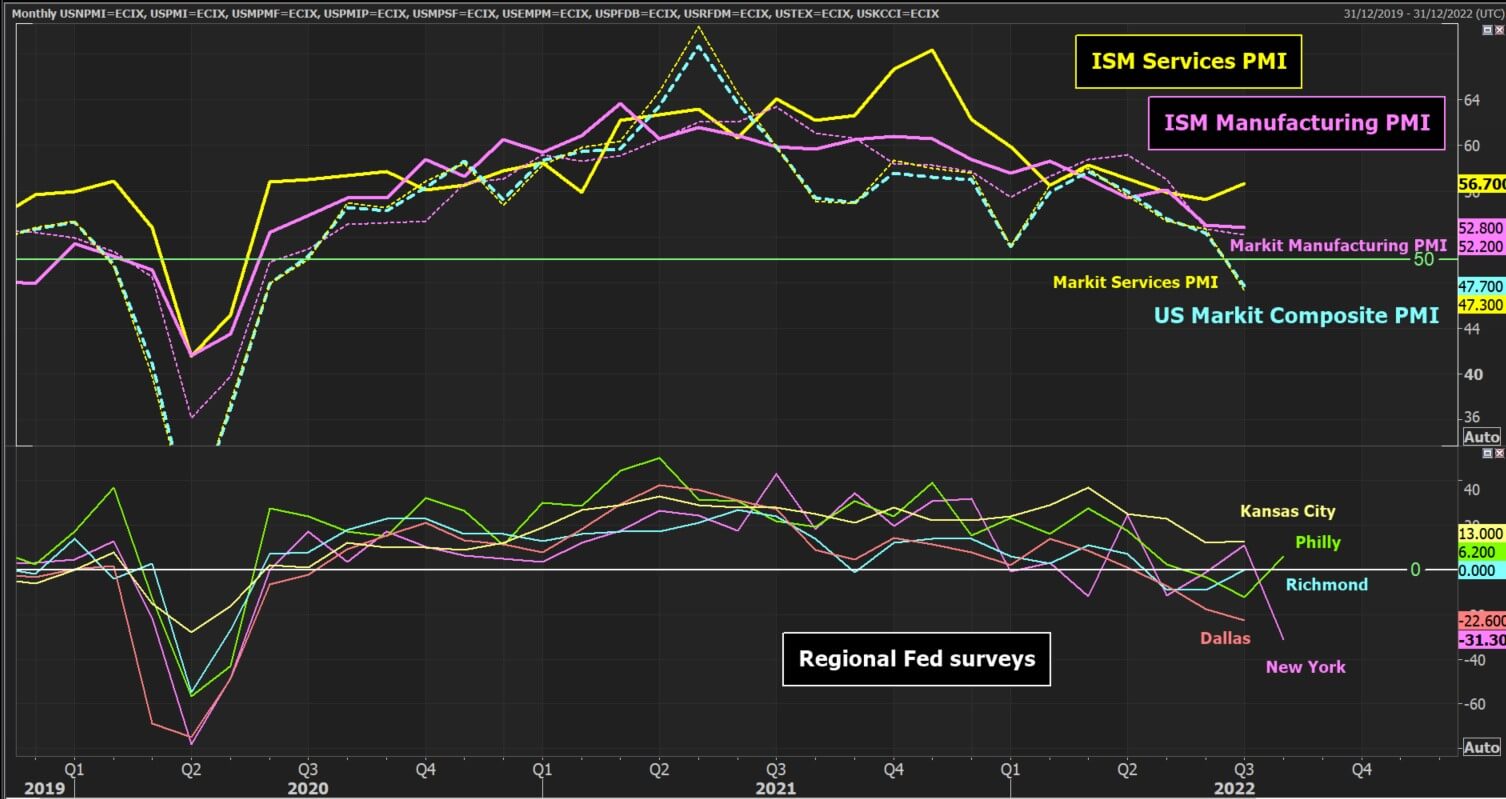

We are almost looking at a week of two halves. The August flash PMIs for major economies will paint a picture of how Q3 growth trends are developing around the world. There are signs in the consensus forecasts that the sharp slowdown of May through to July may be moderating.

The second half of the week will be focused on the Federal Reserve’s annual central banker get-together at Jackson Hole. There are plenty of speeches and usually some hints on policy outlook for traders.

Watch for:

- North America – The Jackson Hole economic symposium speeches will be key, along with the US flash PMIs

- Europe – Eurozone and UK flash PMIs and the German Ifo Business Climate

- Asia – Flash PMIs for Australia and Japan

- LatAm – Mid-month inflation for Mexico and Brazil, along with Mexican Q2 GDP

North America

N.B. Forecasts are the latest available consensus

US dollar (USD)

The USD is strengthening once more. According to the June FOMC minutes, the Fed believes that this will help reduce inflation. So there is little reason to believe the Fed will talk USD lower for the time being. Subsequently, a bias of USD strength is likely to remain in play. The flash PMIs are expected to show a slight improvement to the Composite in August (although still below 50). This should help sustain USD outperformance.

The main event of the week will be Fed Chair Powell speaking at Jackson Hole. In previous years, Jackson Hole has been used as a key event to guide Fed policy. Last year, Powell was a massive bum steer, insisting that inflation was “transitory”, there was plenty of slack in the labor market and wage growth was not an inflationary problem. He will be keen to not make similar mistakes.He is likely to argue that further policy tightening is required. Additionally that markets should expect interest rates to remain elevated for some considerable time.

Canadian dollar (CAD)

There is no major Canadian data this week. CAD continues to be one of the less volatile major currencies (i.e. it is more aligned to the USD), so the focus will be on what comes out of Jackson Hole. A weaker oil price will also keep CAD suppressed.

- USD/CAD – the outlook has fluctuated over recent weeks, however, the USD strength is beginning to take hold. A move above the August high resistance at 1.2985 opens the trend channel highs once more towards a test of 1.3075/1.3160. Weakness is a chance to buy.

Commodities

US Treasury yields are moving higher and the USD is strengthening once more. This is weighing negatively on the outlook for precious metals. For oil, the flash PMIs will paint a picture of the outlook for global demand in Q3. Weaker data from China and the Eurozone has certainly weighed on oil recently.

- Brent Crude Oil – since June, with a series of lower highs, our strategy has been to sell into strength. This remains the case for the latest rebound. Unwinding moves remain an opportunity to sell. We expect further pressure towards $93.25. Resistance at $102.90 will be key this week.

- Gold – the outlook has turned corrective again. We look to use near-term strength into resistance between $1770/$1783 to be a chance to sell. Resistance at $1807 is increasingly important.

- Silver – The breakdown below $19.54 has opened $18.90/$19.10 support initially but the key low at $18.14 cannot be ruled out now. We look to use strength as a chance to sell. Resistance is mounting between $19.54/$19.90.

Wall Street

With Treasury yields moving decisively higher and the USD strengthening, the potential to take profits on Wall Street is growing. However, if a risk negative bias continues this week, we could see a corrective move developing.

- S&P 500 futures – as the bull run has stalled, there are growing signs of near-term corrective momentum. This could pull the futures back towards the 4170/4200 breakout support area. If this can hold, then it would be a chance to buy again.

- NASDAQ 100 futures – a corrective move has been threatening to unwind some of the bull run. A retreat back towards the breakout support around 12960 could be seen. However, if the bulls can build support before then, it would be seen as a chance to buy again.

- Dow futures – With momentum starting to unwind, a near term corrective move could drag the market back towards the breakout support around 33300/33430. If this support can hold then it would be seen as a chance to buy.

Europe:

N.B. Forecasts are the latest available consensus

Euro (EUR)

It is still difficult to see a path to any sustainable EUR recovery whilst the economic data continues to deteriorate. This week’s flash PMIs and German Ifo are likely to continue this trend. As currency volatility has increased in the past week, Eurozone core/periphery yield spreads have increased. This is also negative for EUR near term.

- EUR/USD – breaking below 1.0095 support is a key move. It opens parity once more, with the July low at 0.9950 also within range. With momentum indicators turning corrective our strategy is increasingly to sell into near-term strength. Resistance is between 1.0095/1.0200.

British pound (GBP)

There seems to be a significant credibility issue with the Bank of England right now. Despite UK inflation continuing to soar into double digits, money markets are pricing for around +75 basis points of hike in the rest of this year (towards 2.50%). GBP remains under pressure. The outlandish spending pledges of the next Conservative Prime Minister (whoever it may be) do not help confidence in GBP either.

- GBP/USD – A downside break of 1.2000 has opened the 1.1760 key July low. With momentum in corrective configuration, we look to use any intraday strength as a chance to sell. Resistance is now 1.1960/1.2000.

Indices

If the negative bias to risk appetite continues, this will weigh on indices. It would also likely see the DAX leading markets lower in Europe.

- DAX – is just beginning to ease lower with the four-week uptrend having been broken. The key support to note this week is the higher low at 13445. If this support is broken then it would confirm a corrective outlook. The importance of resistance at 13970 is growing.

- FTSE 100 – is looking far less assured in the move higher, despite the four-week uptrend being intact. Support at 7492 is initially to be watched, but the support of the first higher low at 7457 is key. We are turning more neutral in our near-term outlook.

Asia:

N.B. Forecasts are the latest available consensus

Japanese yen (JPY)

A growing sense of risk aversion will help JPY to perform relatively better on major crosses. A solid Japanese flash PMI would help. However, this does not include the USD pair, which is once more strongly biased towards a positive USD.

- USD/JPY – has broken strongly higher above the 135.30/135.60 resistance. This now becomes a basis of support as the market looks higher. With bullish momentum, a move above the next resistance at 137.45 opens the highs again at 139.40.

- AUD/JPY – the market remains stuck with a very neutral outlook within a two-month trading range. Moves towards 95.15/95.75 have been selling opportunities. Down towards 91.45/92.00 have been a chance to buy.

Australian dollar (AUD)

The turn to a more risk negative outlook following the weaker Chinese data has hit the Aussie hard. If the flash PMI can hold up this week, then there is some potential for some respite on major crosses. However, the strength of the USD is still weighing on AUD/USD.

- AUD/USD – the support at 0.6860/0.6870 is the key signal this week. A more corrective configuration on momentum continues to weigh on the pair. Resistance is growing at 0.6970/0.7040.

New Zealand dollar (NZD)

The Kiwi has come under considerable corrective pressure despite the hawkish lean from the RBNZ last week. The deterioration in risk appetite and downside in commodities is certainly not helping.

- NZD/USD – the pair has retraced sharply in the past week. Reaction to the 0.6185/0.6210 support band will be key this week. A breakdown opens a much deeper correction. Near-term rallies are a chance to sell, with resistance at 0.6310.

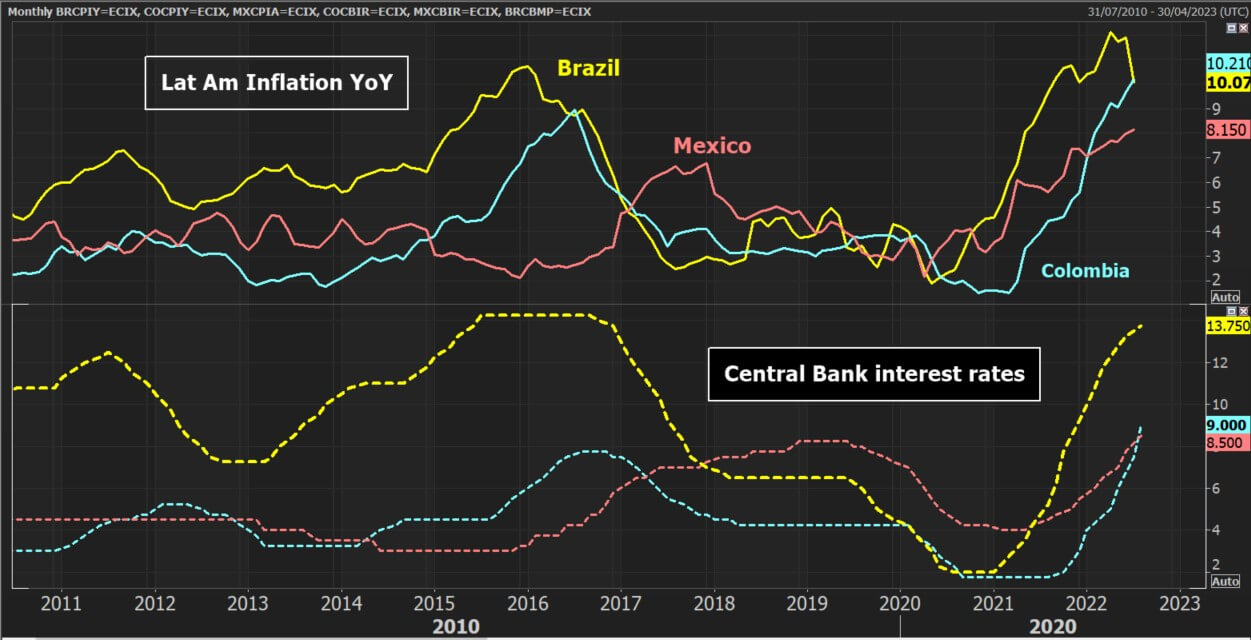

LatAm:

N.B. Forecasts are the latest available consensus

Brazilian real (BRL)

Brazilian inflation is expected to show further signs of turning lower, with mid-month inflation forecast to fall again. The pressure on the Brazilian Central Bank to engage in aggressive hiking is easing. The outlook for the real has been slightly more stable as a result.

- USD/BRL – has been ticking higher as the USD has been strengthening ove the past week. However, there is still an element of stability to the outlook. Reaction to resistance at 5.3100/5.3600 will be the key indicator if the USD continues to strengthen.

Mexican peso (MXN)

1st half month inflation is forecast to follow the recent trend, with a mild move higher. This will do little to change the narrative of higher rates.

- USD/MXN – has swung higher again as the USD has strengthened once more. This remains a market full of twists and turns so is great for the swung traders. The latest move higher has further upside potential this week, even as it hits initial resistance at 20.200/20.350. A move back towards the swing highs that start around 20.700 cannot be ruled out if USD strength continues.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.