In the first week of the month, there will always be a focus on Nonfarm Payrolls, with another decent month of jobs growth expected. However, there is plenty of tier-one data elsewhere this week.

Manufacturing PMIs are also a feature. However, their impact has been slightly reduced with several countries updating with final revisions. The US ISM data subsequently takes the focus, whilst the China PMIs can also drive broad sentiment. We are also looking out for flash Eurozone inflation which is expected to continue to edge higher. This will only add fuel to the mounting expectation of ECB rate hikes.

Watch for:

- North America – US Consumer Confidence, ISM Manufacturing and Nonfarm Payrolls; along with Canadian GDP

- Europe – Eurozone sentiment gauges, inflation and unemployment; Eurozone and UK final Manufacturing PMIs

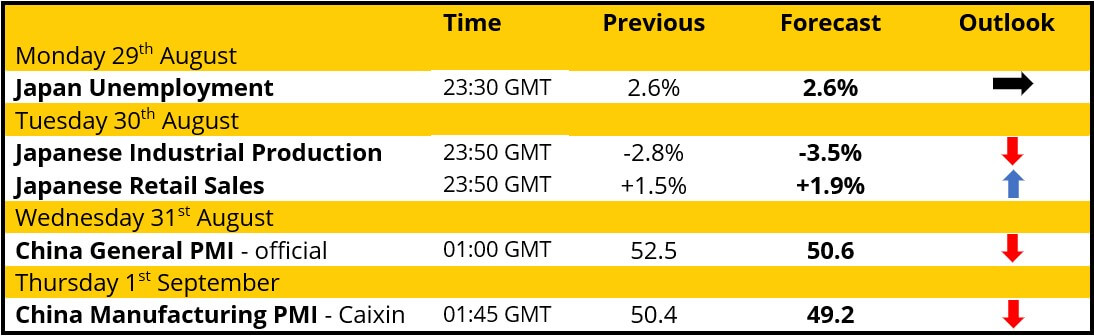

- Asia – Japanese Industrial Production and Retail Sales, Chinese Manufacturing PMIs

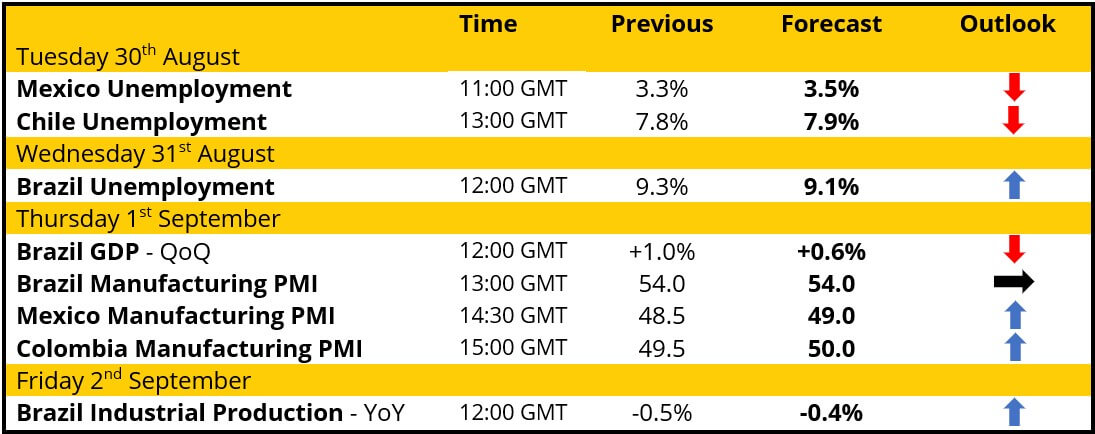

- LatAm – Unemployment for Mexico, Chile and Brazil; with Brazilian GDP

North America

N.B. Forecasts are the latest available consensus

US dollar (USD)

Nonfarm Payrolls growth is expected to be 290000 in August. This would be good enough on its own, but even more so following over 500000 jobs being added in July (even if this comes with a mild downward revision). It would certainly be enough to keep the Fed hawkish and able to focus on inflation (a 75bps hike is now expected at the September FOMC).

We had a few warning signs last week that the USD positive bias may be a crowded trade for forex traders. There is still the risk of a near-term unwind to the USD strength this week. However, with a continued hawkish Fed, even if there is a near-term “long squeeze” on the USD, we would still see this as an opportunity for further USD buying in due course.

Canadian dollar (CAD)

Canadian growth will be key on Wednesday. Q2 growth is expected to be a solid 1.0% while the prelim for July is expected to be a relatively positive +0.3% (anything above zero is a decent return right now). This will keep the BoC on the tightening path and should help to support CAD performance on major crosses.

- USD/CAD – the outlook has fluctuated for the past ten weeks. There is a lack of decisive positioning as USD positive moves that have dragged the pair higher have been consistently hauled back by the CAD. We expect this choppy phase to continue. There is a slight bias for pressure towards the 1.3075 resistance.

Commodities

Last week saw a near-term boost for commodities, following news of China’s minor fiscal stimulus. However, the traction from this is likely to be limited, with rallies vulnerable to renewed selling. The broad economic backdrop of faltering growth trends amidst a hawkish-sounding Fed will keep metals prices under corrective pressure. The noises out of OPEC continue to be leaning towards a lack of ability/willingness to raise production. This will add to support for the oil price.

- Brent Crude Oil – reaction to the resistance around $101.50/$103.50 is key to the near to medium-term outlook. If this can be decisively broken then it would open a move towards $109. A failure below $99.50 would abort the recovery.

- Gold – reaction to the resistance band $1754/$1772 will be key. With the corrective configuration on momentum, bull failure in the resistance will add renewed downside pressure on $1727

- Silver – Reaction to the pivot resistance band $19.38/$19.54 will determine the next direction. If this remains resistance then the lack of momentum in the near-term bounce will weigh and selling pressure will resume for $18.71.

Wall Street

With Treasury yields trending higher and the USD strengthening, the corrective pressure on Wall Street will grow.

- S&P 500 futures – the reaction around the 4170/4200 trading band which is a basis of resistance and a potential new corrective trend will be key this week. The importance of support at 4110 is growing, with 4080 already key.

- NASDAQ 100 futures – if there is another bull failure to form a lower high then the corrective forces will grow this week. Already we see the importance of support at 12825 is growing.

- Dow futures – The pullback has stabilised to leave support at 32750. However, if there is a bull failure and another lower high develops then the corrective move could take hold once more.

Europe:

N.B. Forecasts are the latest available consensus

Euro (EUR)

The EUR has remained under pressure in recent weeks in the drop to parity. However, there is room for a potential short-squeeze which could drive recovery on major crosses. The European Central Bank is concerned by the weakness of the EUR and money markets are pricing for the interest rate to be at 1.25% by the end of 2022 and to peak at over 2.0% in 2023. Higher than expected Eurozone inflation could drive a reaction on EUR higher.

- EUR/USD – has been hanging on to 0.9900 support and is looking to build a near-term recovery. Holding a close above 1.0030 opens the prospect of a near-term rebound into the 1.0100/1.0200 resistance area. We would still see near-term rallies as a chance to sell.

British pound (GBP)

GBP continues to struggle for positive traction. This is despite money markets pricing now for much higher interest rates during next year (perhaps double the current 1.75%). The economic data continues to paint a terrible picture of high inflation and negative growth. The reason why GBP cannot rally is that traders just do not believe the Bank of England can tighten significantly without causing significant economic damage. There is room for a short squeeze on GBP. Markets might just need a catalyst. The PMIs have disappointed in recent months.

- GBP/USD – building support at 1.1717 the potential is still there for near-term recovery. Holding a breakout above 1.1890 opens the prospect of near-term recovery into 1.2000. However, we would still see this as a rally within a bigger downtrend and would be a chance to sell.

Indices

Sentiment has not been entirely negative on European indices, however, rallies are still struggling for traction. The higher growth DAX performance relative to the more defensive FTSE 100 remains a good gauge for where sentiment is trending.

- DAX – reaction around the 13330/13450 resistance band will be key this week. A near-term rebound is faltering and with momentum indicators turning corrective, we see near-term strength as a chance to sell. A move below 13000 increases corrective momentum.

- FTSE 100 – resistance is growing around 7530/7545 and a near-term corrective move is gaining momentum. A move below 7411 opens the 7335/7370 support band.

Asia:

N.B. Forecasts are the latest available consensus

Japanese yen (JPY)

Yield spreads have widened but the yen has performed well (especially versus EUR and GBP) due to its perception of its safe haven status. It remains the case that if traders are worried about the negative growth outlook in Europe (both Eurozone and UK) then JPY will perform well.

- USD/JPY – holding above the 135.30/135.60 pivot band helps to maintain a positive bias to the outlook. A move above 137.70 opens the 139.40 multi-year highs again.

- AUD/JPY – the strength of AUD has pulled the pair towards a test of the 95.30/95.75 resistance band again. A decisive move above opens the multi-year high of 96.88 again. The importance of support at 93.05 is growing.

Australian dollar (AUD)

With the Australian Manufacturing PMI just a final revision, there are two issues to consider this week. Firstly whether the AUD can sustain recovery momentum from the China fiscal stimulus (we are doubtful) and secondly whether there is a short squeeze on the USD. AUD remains better positioned than most major currencies.

- AUD/USD – there has been more of a positive bias forming over the past week, which has sustained a neutral medium-term outlook. A move above 0.7040 further improves the near-term outlook. The support at 0.6855/0.6875 is strengthening.

New Zealand dollar (NZD)

With no major New Zealand data of note, the NZD will be largely following the AUD outlook.

- NZD/USD – the pair has stabilised after the sharp retracement. However, there is considerable resistance initially between 0.6245/0.6300 to overcome to generate recovery momentum once more. The importance of support at 0.6165 is growing.

LatAm:

N.B. Forecasts are the latest available consensus

Brazilian real (BRL)

Last week, the mid-month inflation showed further signs of peaking inflation. This week, with unemployment forecast to continue to decline and the Manufacturing PMI expected to remain solidly above 50, this points to at least a stable economic outlook developing in Brazil. This should help to underpin the BRL.

- USD/BRL – the BRL recovery in the past month has dragged the pair back lower. Moves in the past couple of weeks have been more uncertain but there is still a mild corrective bias. Reaction to support between 5.0500/5.1000 will be important, whilst lower high resistance is now at 5.26.

Mexican peso (MXN)

Unemployment is forecast to edge higher in July, and although this is from a very low base, this will still need to be watched. The peso has been a relatively strong performer in recent weeks, despite the USD strengthening. A forecast uptick in the Manufacturing PMI will play into this, even if it is still slightly in contraction territory below 50.

- USD/MXN – this remains a market full of twists and turns so is great for the swung traders. The latest rebound has faltered to leave resistance between 20.250/20.350. Important support at 19.800 will need to hold to prevent a more negative outlook from forming.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.