Aside from the US CPI, it was slim pickings for data traders last week. However, we now move into what promises to be a far more interesting week. The economic calendar is stacked with tier one data.

US Retail Sales and Industrial Production will be important for USD traders, in addition to the Fed minutes. GBP could be in for a volatile week with UK unemployment, inflation and retail sales on consecutive days. Inflation also comes from Japan whilst another rate hike is expected from the Reserve Bank of New Zealand. In Lat Am, all eyes are on Q2 GDP for Colombia and Chile.

Watch for:

- North America – retail sales & industrial production for the US along with FOMC minutes; whilst Canadian inflation is also due

- Europe – UK labour market data, CPI and retail sales. German ZEW and revised Eurozone Q2 growth

- Asia – The RBNZ rates decision, Aussie unemployment and Japanese core inflation

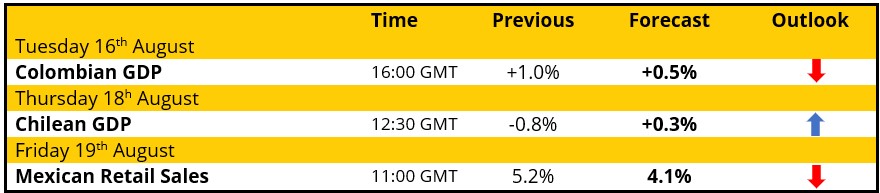

- LatAm – Q2 GDP for Colombia and Chile

North America

USD

USD

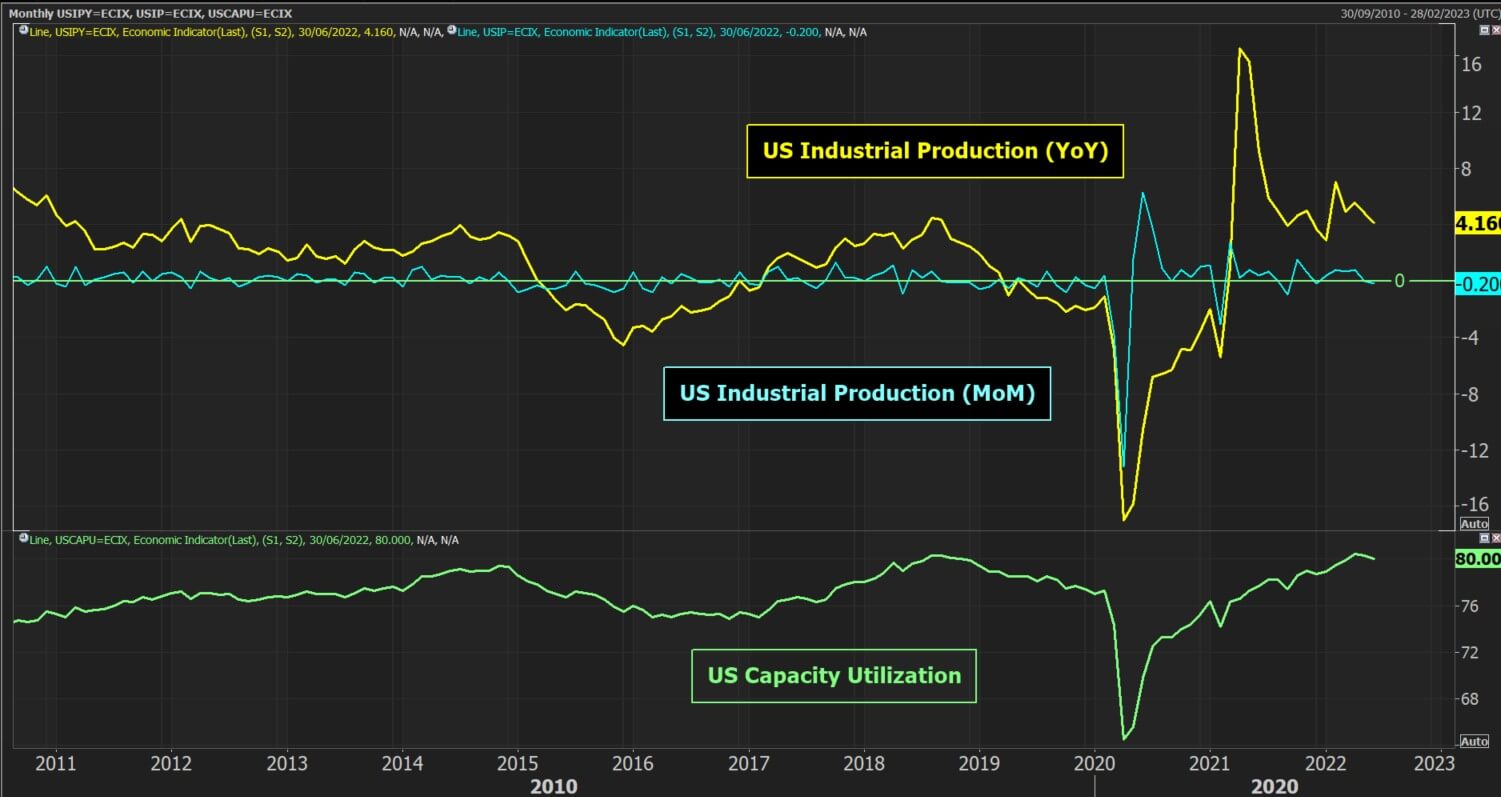

The USD has been weakening again as data has continued to reflect peak inflation has been reached. However, Fed speakers remain staunchly hawkish with “the job not yet done”. The focus turns more towards economic activity early in Q2 this week, with retail sales and industrial production for July. Both are expected to be sluggish. This may begin to weigh on the outlook for Q2 GDP which is currently sitting around +1.2% annualised.

The question for traders is whether the USD correction continues lower this week. We see 105.00 as a gauge for Dollar Index. Continued trading below this old support will add to a corrective outlook.

CAD

Inflation will be the big focus for CAD traders this week. The forecasts suggest Canada will follow the US in its signs of reaching peak inflation. Hitting (or below) headline and core CPI could subsequently weigh on CAD.

- USD/CAD – has turned corrective within the broad (but shallow) 15-month uptrend channel. Momentum suggests selling into near-term strength for moves towards the channel lows c. 1.2620. Resistance is between 1.2770/1.2820. A key lower high is at 1.2985.

Commodities

Precious metals have been struggling for traction in the past week. US inflation expectations have been sliding lower in the past couple of weeks. This is helping real yields higher. Gold and silver have struggled for upside traction in the past week. This is countering the impact of a more corrective USD. Falling inflation and faltering growth signals continue to weigh on oil.

- Brent Crude Oil – breaking above $102.50 has engaged another near-term technical rally. However, this is still within the downtrend of lower highs and we look for a failing rally to be sold into. Resistance is around $106.40.

- Gold – the recovery is losing upside momentum and a near-term correction is threatening. A move below $1783 opens a correction towards the key $1754/$1764 support. Above $1805 re-opens $1840/$1854.

- Silver – Sliding below $20.45/$20.60 leaves the market at risk of slipping further towards $19.54 this week. The bulls need a response otherwise the recovery could quickly reverse lower.

Wall Street

Earnings season is all but done now, so Wall Street may need broader market catalysts. US Treasury yields are holding ground, but real yields are rising. Although technical momentum remains strong, this could begin to restrict the positive momentum of the Wall Street rally.

- S&P 500 futures – a strong uptrend remains intact. Holding above the 4200 breakout sustains the bullish bias. A breakout above 4302 would be the next step forward this week. The importance of support between 4080/4115 is growing.

- NASDAQ 100 futures – the breakout above 12945 has been strengthened as this has become a basis of support now. Closing above 13560 would be the next step forward in the recovery and would open 14300.

- Dow futures – holding a break of the resistance at 33430 will be a key confirmation of the increasingly bullish outlook. The RSI coming into the week around 70 is a caveat but any near-term unwinding weakness is a chance to buy.

Europe:

EUR

EUR

Eurozone data is largely revisions this week (2nd reading of Q2 GDP and final inflation). However, the German ZEW is read through to German economic growth, so will be watched. Core/periphery yield spreads continue to fall and are back around one-month lows. Yields on Italian government bonds over German are just over 200 basis points now (below 195bps would be a positive signal). This has helped to support the EUR in the past week.

- EUR/USD – with the break above 1.0295, the bulls will be looking to build support around 1.0250/1.0295. There is still a positive bias to the near-term outlook as the key test of resistance at 1.0350 looms. The near-term uptrend is meeting the medium-term downtrend now.

GBP

A 50bps hike from the Bank of England was accompanied by the projection of a multi-quarter recession on the way. We get an idea of how the UK economy is faring into Q3 this week. Inflation will get the headlines, with 10% headline CPI looming as a possibility. Retail sales are expected to remain under pressure in July. Consumer spending measures are under pressure from the huge rise in the cost of living. This will add to pressure on the Bank of England which will find it increasingly difficult to fight inflation in the coming months.

- GBP/USD – a bull failure at the 1.2295/1.2330 resistance has re-affirmed a trading range between 1.2000/1.2295. A closing breakout either way will drive direction.

Indices

The FTSE 100 has been lagging in the risk recovery, with gains of under +5% in the past month. Of the major European markets, it is interesting to see the French CAC leading the way, up almost +10%. The DAX is in the middle at c. +7.5%.

- DAX – is looking solid within its recovery trend. Holding breakout support at 13440 adds to this conviction. Closing decisively above 13800 continues the recovery with the next resistance of note not until 14300.

- FTSE 100 – the recovery is looking less assured as a three-week uptrend is seriously creaking. Despite this, a run of higher lows remains intact and weakness is still being bought into. Above resistance at 7533 re-opens the way towards key resistance at 7650.

Asia:

JPY

JPY

US yields remain stubbornly high despite falling inflation. With such a strong correlation for USD/JPY with the 10-year yield spread of USTs and JGBs, the recent divergence with USD/JPY (due to the decline in USD/JPY) may not last. We favour a rally in the USD/JPY to correct the divergence.

- USD/JPY – has been very choppy in the past couple of weeks, with big intraday swings. Dips into the 131.50/132.50 band seem to attract buyers. Sellers seem to control again around 135.30/135.60.

- AUD/JPY – Aussie bulls are back in control for now as the market moves higher to test the 95.30/95.75 resistance this week. This marks the top of a two-month trading range. A breakout would open the 96.88 high again.

AUD

Australian unemployment is expected to remain at 3.5% this week. However, watch the Aussie on the back of the RBNZ decision (see below) as there may be an associated move with the Kiwi.

- AUD/USD – the increasingly positive near to medium-term outlook has been bolstered following the breakout above the 0.7045/0.7070 resistance. Holding this breakout opens the way towards 0.7280.

NZD

The Reserve Bank of New Zealand is expected to hike rates by another 50bps this week. This would bring the Official Cash Rate to 3.0%. Q2 headline inflation jumped to 7.3% with wage growth also higher. However, the path of further rate hikes could be revised lower. Concerns over economic growth, the tick higher in unemployment and exposure to a slowdown in China may leave the RBNZ more cautious about the path forward. A terminal rate of 4.0% may be reduced.

- NZD/USD – having built from support at 0.6190/0.6210 the recovery has exploded higher once more. We look to use any near-term weakness into 0.6350/0.6395 support as a chance to buy for a continued recovery towards 0.6575.

LatAm:

BRL

BRL

There is no significant Brazilian data this week. However, USD weakness has allowed currencies from emerging markets to recover.

- USD/BRL – is forming lower highs and lower lows over the past month to engage a correction. There is now resistance between 5.3200/5.3600 and another lower high under here would be an opportunity to sell once more.

MXN

Mexican Retail Sales are expected to falter slightly year on year. Any weaker than forecast result would weigh on MXN.

- USD/MXN – an uncertain outlook has taken on more of a negative bias recently, amid USD weakening. A downside break of 20.200 leaves an area of overhead supply now between 20.200/20.310. We look to use near-term strength as a chance to sell towards support at 19.815.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.